Continuity of Care When Changing Health Insurance Providers

If your current health insurance provider isn’t meeting your communication, care, or coverage needs, you […]

Pre-existing conditions can have an impact on available coverage and premium costs of life insurance plans. But understanding what classes as a ‘pre-existing’ condition, and how they impact life insurance options and prices, is highly important to ensure that you find the best possible cover.

A pre-existing condition includes any injury, illness or health issue which you had symptoms of, received advice for, have been treated for, or had been diagnosed with before applying for life insurance. This includes both current and past conditions:

* Please note, the above medical conditions are not an exhaustive list.

It can be difficult to recall all issues you might need to disclose to an insurer, but working with an intermediary such as Dragonfly Crowd allows us to help you consider anything you might need to disclose as you apply for insurance, ensuring legitimate coverage.

The main reason you need to advise insurers of pre-existing conditions is so that they are fully informed and will likely pay out for future policy claims. Pre-existing illnesses won’t necessarily mean you’re not eligible for life insurance.

Failure to inform an insurance company about any pre-existing conditions could lead to an investigation into your medical history when you make a claim. If the insurer finds out that you withheld information, even if it wasn’t a calculated choice, they may have the right to reject your claim, or even cancel (void) your plan.

You have a legal and contractual obligation to answer all questions honestly upfront, taking reasonable care not to misrepresent your medical history. Failure to disclose could also lead to being denied life insurance in future.

Secure Life Insurance with Dragonfly Crowd

Yes, you can change life/health insurers if you have a pre-existing condition. Whilst the process might not always be simple, it is absolutely possible to re-evaluate current coverage, your life and health circumstances, and change insurers for the better.

Changing insurers with pre-existing health conditions is significantly easier when working with an intermediary such as the expert team as Dragonfly Crowd, to search a panel of insurers and assess all options for bespoke cover.

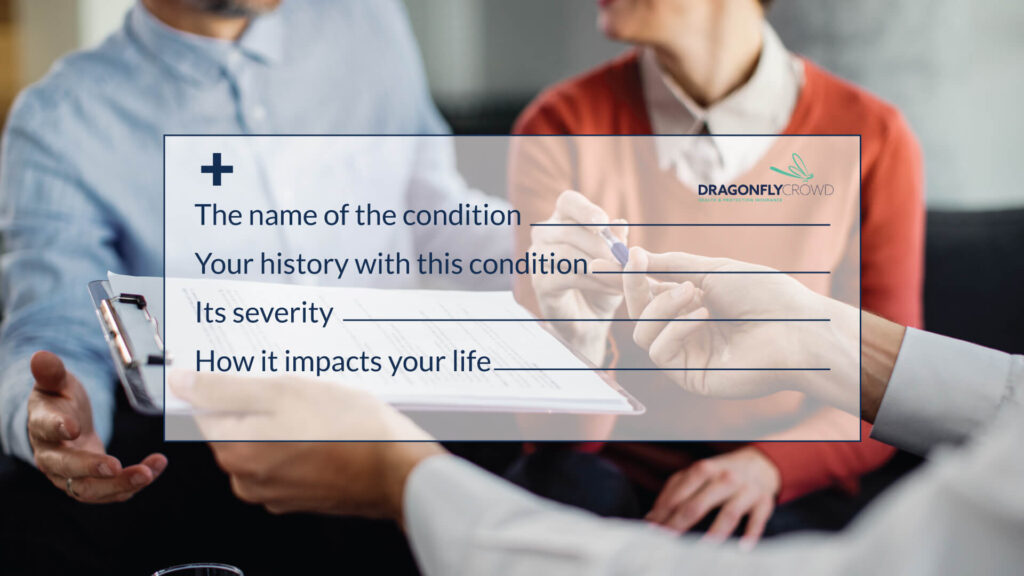

You need to give a new insurer information about pre-existing conditions, including:

You may also need to disclose medication you regularly take, hospital visits, referrals and even family history related to the condition (if any). This can be difficult to remember/pull together (such as finding condition details, impact, medical and family history), but being guided through the process by an expert team can really help.

To find out more on how Dragonfly Crowd can help you secure the most appropriate life insurance for your circumstances, give us a call on 01204 866902.

Learn About Life Insurance with Our Expert Team

Pre-existing conditions can affect and increase life insurance premiums because they mean you are perceived by insurers as a higher risk individual. These conditions may make it more likely that you become ill, meaning that they’ll have to pay out to your beneficiaries.

Whilst premiums can be increased to cover this ‘risk’, it’s not necessarily always the case. It’s still entirely possible to get a life insurance plan which comprehensively protects yourself and your family, and is fundamentally good value for money. Using an intermediary, who can search a wide panel of insurers, is the best way to ensure that you’re getting bespoke cover, from professionals who care.

At Dragonfly Crowd, our services don’t just end after finding you a great plan. We aim to uphold lasting relationships with our customers, so you are able to get as much as possible from your life insurance and other insurance types. Get in touch today to find out more.

If your current health insurance provider isn’t meeting your communication, care, or coverage needs, you […]

Many people worry what the impact of changing health circumstances will be on their life […]

A cancer diagnosis is a shock to anybody, and it’s incredibly difficult to navigate the […]

Simply provide us with your information, and we'll promptly get in touch (typically within 24 hours on weekdays) to discuss your health insurance requirements. Afterward, we'll follow up with your complimentary quote (usually within a week).